north dakota sales tax rate 2021

In North Dakota theres a tax rate of 11 on the first 0 to 40125 of income for single or married filing taxes separately. Their tax is 549.

Sales Taxes In The United States Wikipedia

2022 North Dakota state sales tax.

. The North Dakota sales tax rate is currently. If either or both spouses were part- or full-year nonresidents of. Lowest sales tax 45 Highest sales tax 85 North Dakota Sales Tax.

The minimum combined 2022 sales tax rate for Fargo North Dakota is. The minimum combined 2022 sales tax rate for Bismarck North Dakota is. Find 49900 - 49950 in the.

Look up 2021 North Dakota sales tax rates in an easy to navigate table listed by county and city. Local tax rates in North Dakota range from 0 to 35 making the sales tax range in North Dakota 5 to 85. State Sales Tax The North Dakota sales tax rate is 5 for most retail.

New local taxes and changes to. The minimum combined 2022 sales tax rate for Minot North Dakota is. This is the total of state county and city sales tax rates.

This is the total of state county and city sales tax rates. What is the sales tax rate in Fargo North Dakota. The minimum combined 2022 sales tax rate for Battleview North Dakota is.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes.

Find your North Dakota. This is the total of state county and city sales tax rates. Wednesday September 14 2022 - 0900 am.

Part- or full-year nonresident. Exact tax amount may vary for different items. 2022 North Dakota state sales tax.

The North Dakota sales tax rate is currently. The North Dakota sales tax rate is 5 as of 2022 with some cities and counties adding a local sales tax on top of the ND state sales tax. The North Dakota sales tax rate is currently.

Average Sales Tax With Local. This is the total of state county and city sales tax rates. Exact tax amount may vary for different items.

North Dakota has a 500 percent state sales tax rate a max local sales tax rate of 350 percent and an average combined state and local sales tax rate of 696 percent. North Dakota has a statewide sales tax rate of 5 which has been in place since 1935. 373 rows 2022 List of North Dakota Local Sales Tax Rates.

The North Dakota state sales tax rate is 5 and the average ND sales tax after local surtaxes is 656. City of Bismarck North Dakota. Local Taxing Jurisdiction Boundary Changes 2021.

North Dakota sales tax is comprised of 2 parts. If youre married filing taxes jointly theres a tax rate of 11. Pursuant to Ordinance 6369 as adopted May 12 2020 the boundaries of the City of Bismarck.

Their North Dakota taxable income is 49935. With local taxes the total sales tax rate is. The minimum combined 2022 sales tax rate for Williston North Dakota is.

With local taxes the total sales tax rate is between 5000 and 8500. This is the total of state county and city sales tax rates. The sales tax is paid by the purchaser and collected by the seller.

Exemptions to the North Dakota sales tax will vary. Free sales tax calculator tool to estimate total amounts. 30 rows The state sales tax rate in North Dakota is 5000.

Tax Commissioner Brian Kroshus announced today that North Dakotas taxable sales and purchases for the second quarter of. The base state sales tax rate in North Dakota is 5. The North Dakota sales tax rate is currently.

.png)

State And Local Sales Tax Rates Midyear 2013 Tax Foundation

Bill Would Establish Flat Income Tax In North Dakota Kvrr Local News

Economic Nexus State Chart State By State Economic Nexus Rules Sales Tax Institute

:max_bytes(150000):strip_icc()/2021StateIncomeTaxRates-2fb0a8148ecb444c8d1399d839a69ffb.jpeg)

State Income Tax Vs Federal Income Tax What S The Difference

Sales Tax 2021 Lookup State And Local Sales Tax Rates Wise

Cities Need More Flexibility In How They Tax

North Dakota Income Tax Calculator Smartasset

State Income Tax Rates Highest Lowest 2021 Changes

Are There Any States With No Property Tax In 2022 Free Investor Guide

North Dakota Retirement Tax Friendliness Smartasset

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

Minnesota Among Top 5 States With Most Progressive State Income Tax Systems American Experiment

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Welcome To The North Dakota Office Of State Tax Commissioner

North Dakota Sales Tax Small Business Guide Truic

North Dakota Tax Rates Rankings Nd State Taxes Tax Foundation

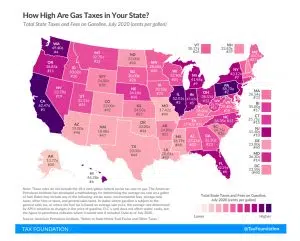

Nd Lawmakers To Consider Gas Tax Increase Knox News Radio Local News Weather And Sports